Beyond the Boom: How VC is Maturing in Latin America

Leveraging our fund-of-funds strategy, we've gained a panoramic view of Latin America's VC evolution, granting us a front-row seat to the region's transformation. This exposure, encompassing a wide range of investment strategies, allows us to identify durable industry trends, glean valuable insights and learn as much as possible and as quickly as possible from industry experts. Durable trends can provide opportunities for alpha generation, which is why we invest in funds managed by experienced investment teams with a deep understanding of specific sectors or investment theses. Having witnessed this remarkable journey firsthand, we'd like to share our perspective on how LatAm VC has unfolded.

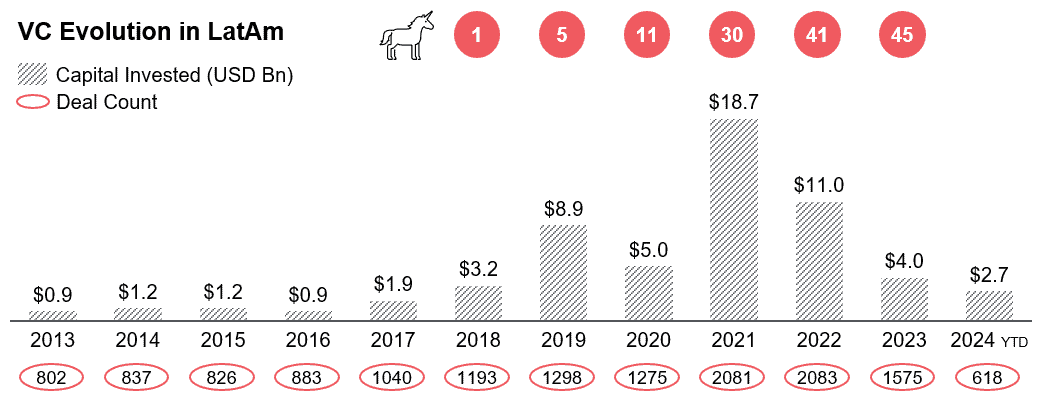

A Downturn After the Boom

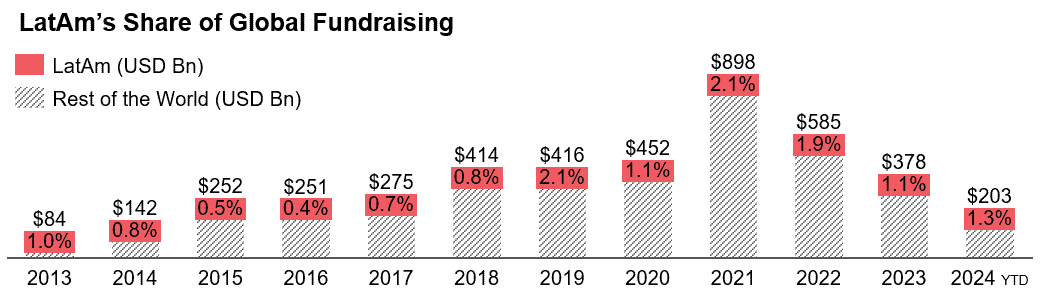

Initial concerns regarding a complete halt to VC investment in LatAm appear to be overstated. However, it is undeniable that investment activity has fallen considerably compared to the peak levels witnessed in 2021 and 2022. Following a record-breaking year in 2021, VC funding in LatAm has experienced a significant decline, with foreign investors pulling back.

According to Dealroom, VC investment in the region dropped by a staggering 60% in 2023.

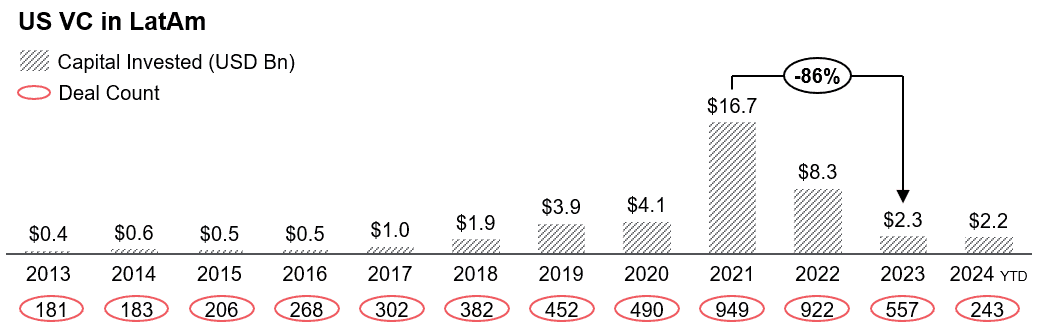

The following chart highlights the declining presence of US VCs in Latin America.

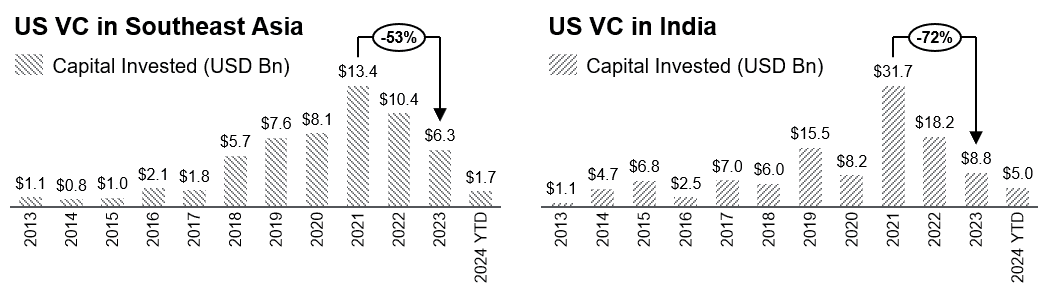

Latin America was harder hit by the downturn than Southeast Asia or India.

This downturn is attributed to:

- The global economic slowdown has led investors to become more cautious about risk, shifting their investment strategies towards more conservative options.

- A rising interest rate environment has made it more expensive to invest in startups, causing a reduction in valuations and greater competition for capital.

- Private assets tend to lag when it comes to the downside, leading to LPs having larger stakes in PE / VC relative to other (i.e. liquid) asset classes and a need to reduce new commitments.

- Political and economic uncertainty natural to Latin America has popped up again and created a shadow of doubt on the region and deterred foreign investors.

There is still a strong demand for funding from the region’s startups. Brazil continues to be the primary destination for capital given the region’s favorable regulatory backdrop, strong tech acceptance amongst both businesses and consumers and growing talent pools. Its success is setting the precedent for Spanish-speaking LatAm. Unfortunately, no other country in LatAm is in a similar position. Firms across Spanish-speaking LatAm have struggled with scale and PMF across a variety of verticals and foreign investors are more hesitant to invest in a region with no IPOs and few big-ticket M&A deals.

With sufficient capital, reputation, and maturity within the ecosystem, domestic investors are starting to build in-house investment capabilities. While some limitations persist, a new wave of domestic growth funds is emerging to bridge the funding shortfall created by the pullback in foreign capital.

We have identified three patterns associated with the emergence of domestic growth funds:

- Experienced Growth Equity Investors: US-based or trained managers that recognize the potential and untapped opportunities in the Latin American market. Whether through their native Latino background, direct experience in the market or expertise gained from navigating growth equity markets in other regions, the managers possess the acumen to thrive in LatAm. By leveraging their credentials, proven track record of deploying large amounts of capital and experienced teams, it’s easy for them to raise a LatAm-focused vehicle.

- Established Early-Stage Brands moving into Growth: domestic well-known early-stage brands are venturing into growth-stage investing with larger “early-stage” funds. They have set the stage by building a track record with their opportunity funds, hiring experienced teams and potentially raise dedicated growth equity funds. This mirrors the success of renowned venture capital firms in other markets which have established their reputation as go-to brands capable of supporting companies throughout their entire lifecycle.

- Domestic Upstarts with Smaller, Concentrated Portfolios: LatAm-first players are carving a niche in the growth equity space. They are leveraging their regional expertise to raise smaller funds (~$100M) and invest larger amounts in Series A-B companies. This strategy enables them to build concentrated portfolios with lower risk while playing a crucial role in bridging early-stage ventures with traditional growth equity / private equity.

It’s no news that landing a new VC fund isn't a cakewalk these days. In 2023, most of the money raised actually went to existing firms. Shockingly, 70% came from just two firms. This is a big shift from the past couple years, when there were tons of new VC managers launching their first funds. However, there's still a silver lining. Even though it's tougher for new funds to get started, the total amount raised over the last three years is still substantial, meaning there's still plenty of cash out there for promising startups.

Shifting Investment Focus: A Flight to Quality

With a more cautious approach dominating the market, VC investors in LatAm became more selective. The focus shifted towards later-stage startups with proven business models, strong unit economics, and a clear path to profitability. Seed-stage funding, which boomed in 2021, became more challenging to secure, with seed founders facing longer fundraising timelines. This shift presented an opportunity for established startups with a solid track record. They were able to raise capital at more reasonable valuations compared to the peak periods. However, early-stage ventures with unproven concepts and high burn rates struggled to attract investors.

On another note, VCs are playing it safe. They're prioritizing supporting companies they've already invested in (their portfolio) instead of taking a chance on new startups, especially in the early stages. This focus on familiar ground is reflected in a rise in follow-on investments (backing existing companies) - reaching nearly half of all early-stage funding in 2023. This shift from the historical average makes it tougher for fresh startups to find the capital they need to get started.

Long-Term Potential: A Market Ripe with Opportunity

Despite the short-term challenges, the fundamentals of the LatAm VC landscape remain strong. The region boasts a large and growing population, a rising middle class with increasing disposable income, and a rapidly adopting tech-savvy demographic. These factors continue to create a fertile ground for innovative startups across various sectors like fintech, proptech, logistics and e-commerce.

The experience of 2023 could lead to a more sustainable and value-driven VC ecosystem in LatAm. With a focus on profitability and long-term growth prospects, startups in the region are likely to emerge stronger and more resilient in the future.

References

https://www.bbvaspark.com/contenido/en/news/venture-capital-latin-america/